With sustainability becoming high on the agenda of many sponsors’ boards and with Environmental, Social and Governance (ESG) matters becoming a focal point in debt and equity markets, Elgar Middleton can assist in incorporating ESG-linkage into any debt facility and equity raise.

ESG-Linked Debt Facilities

Sponsors are increasingly driving the inclusion of an ESG-framework in their debt structure.

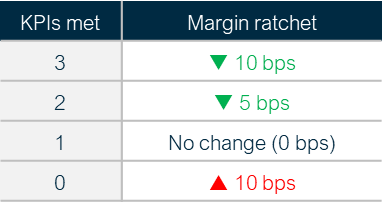

ESG-linked loans seek to encourage sponsors and investors to improve their sustainability performance through a monetary reward for complying with pre-agreed targets, and a penalty for missing them.

This is typically achieved by including an ‘ESG ratchet’ on the margin. See below an indicative margin ratchet framework.

Elgar Middleton can incorporate ESG-linkage into a variety of different debt products including revolving credit facilities, senior term loans and mezzanine debt.

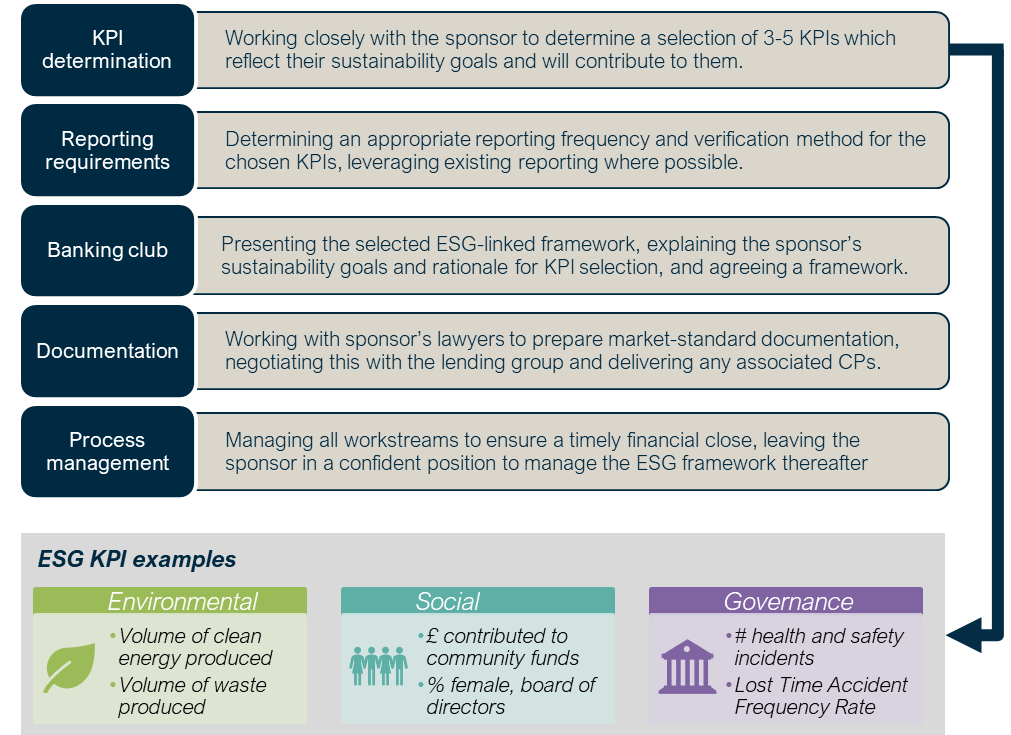

Sample scope of works for an ESG-linked debt facility

ESG-Linked Equity Raises

Similar principles can be applied in the context of an equity raise.

For example Elgar Middleton can structure a shareholder loan with an ‘ESG ratchet’ being applied to the coupon rate – with a positive premium for failing to meet pre-determined KPIs, and a reduction for meeting them.

Alternatively, we can assist developers in raising finance with a monetary reward, in the form of deferred consideration, being paid out upon the achievement of pre-agreed ESG KPIs at some time frame following the initial financial close.

To learn more about how Elgar Middleton can help incorporate ESG-linkage into your debt facility or equity raise, please get in touch.