The situation at present

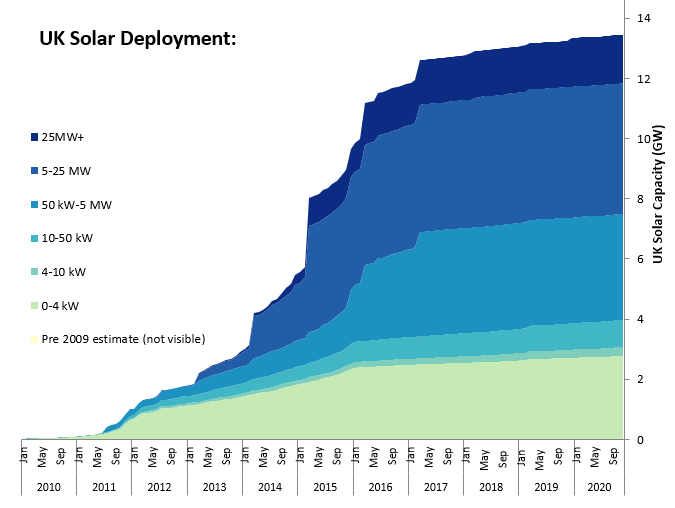

UK solar deployment enjoyed steady growth from 2011 through to the end of March 2017 with over 13GWs connected to the UK grid. Over the past 4 years, only around 500MW have been added, with the majority of this being rooftop.

Following the abolishment of any meaningful Government support scheme, ground mounted solar deployment ground to a halt in the first quarter of 2017. While the cost of solar panels continues to plummet, power prices have also declined (exacerbated by the COVID-19 pandemic) in the UK and this has resulted in a total dearth of any meaningful deployment in the past four years. The underlying unlevered return on investment simply does not justify capital deployment given the subsidies typically represented 50% of previous revenue structures. It was the subsidy component of the revenue structure that enabled financial institutions to provide significant debt financing, on favourable terms, in order to enhance the overall equity returns. With the curtailment of subsidies, the mainstream banking sector has been unwilling to lend into ground-mounted solar in the UK.

Several studies have suggested the UK requires between 70GW and 185GW of solar as part of its energy strategy by 2050 and the UK Government’s own Energy White Paper modelling proposes between 80GW and 120GW; implying an annual deployment of 3GW per annum for the next 30 years.

So where will it come from

While there is a shortage of actual deployment of new solar on the ground, the rate of growth of planning and development is accelerating. By the end of 2018, there was approximately 3GW of solar development (at various stages) and this has expanded to over 13GW at the end of 2020 with 1GW of new developable solar being added to the pipeline each month. While over 8GW is at the screening/scoping stage, some 3GW is consented and ready to build out subject to the satisfaction of planning conditions. The vast majority of these sites are 49.9MWp thus avoiding the need to be approved by the Secretary of State for Business, Energy and Industrial Strategy (BEIS) which applies to sites over 50MWp. This is not to say seeking consent for larger sites is impossible – for example, Cleve Hill (350MWp) successful achieved statutory approval on 28 May 2020 and at least 10 further projects over 200MWp are at various stages of development. So over time it is almost certain the size of projects and the scale of investment will grow as utility scale solar deployment will become the norm.

The importance of CFDs, corporate & utility PPAs

Ground-mounted solar sites greater than 10MW will qualify for the forthcoming Contract for Difference (CFD) auction, although it is unknown how much capacity will be allocated to UK solar. At present 3GW of sites will qualify for the auction and given it may not happen for a further 12 months, in all likelihood there will be 5GW of qualifiable sites by then, most certainly far exceeding the capacity on offer in the auction. This will undoubtedly drive down the strike price to levels that potentially may even make investment unattractive.

The vast majority of new solar will almost certainly be built out without a Government support tariff and will have to rely on either a corporate or utility Power Purchase Agreement (PPA). With ever increasing demands for power and a desire for corporates to become carbon neutral more and more of the technology, power intensive orientated growth stocks (Google, Microsoft, Amazon etc.) will seek to enter into long-dated fixed-price PPAs. These contracts are the holy grail; the buyers really can dictate the terms of the contract and drive down the price of power because the quality of the counterparty and price certainty will enable any solar site with a top tier fixed price PPA to obtain significant levels of debt on extremely competitive terms from the debt market. However, these highly sought after corporate PPAs will be few and far between.

The alternative is a route-to-market utility PPA with one of the UK’s large energy suppliers (often referred to as the ‘Big Six’). These contracts have a strong credit counterparty, often have maturities of up to twenty years and can benefit from a support price floor mechanism. The combination of all of these aspects will maximise the gearing opportunity of the project; and while this will not achieve the same level of gearing as a top-tier fixed-price corporate PPA, it will ensure the project is both bankable and investable.

Technology and innovation will improve returns

Whilst previous solar sites in the UK have been static and simply orientated to the south, developers are now embracing ways to improve a site’s productivity. Innovation is therefore fundamental in improving returns with bifacial modules, trackers and east-west alignment all generating notable enhancements.

Designs and construction now include the use of bifacial panels while Cleve Hill’s design adopts an east-west design layout in order to achieve an optimum return on investment for a finite land parcel. As tracker prices continue to fall the UK may also see these adopted in the future although to date they have been far more common in southern Europe with materially higher solar irradiance.

There has also been much talk of dual solar battery sites and while a small number have been built out in the UK much work has been undertaken into the financial merits of battery supported solar projects to enhance investment returns. As battery pieces continue to fall (now 20% of the price of just 5 years ago) and the storage capacity (up to four hours) of batteries becomes more economic, solar sites coupled with a battery will be able to time shift when it deploys its power to grid (export in the evening, peak price periods) or bid for flexible imbalance grid revenue contracts. There has been significant growth in flexible Fast Frequency Response (FFR) and dynamic services being rolled out by the National Grid and this will only continue to grow to satisfy a power mix with ever increasing intermittent generation. Arbitraging power prices and sourcing flexible and dynamic revenue contracts will enhance the financial attractiveness and investment returns of debt and equity investors.

Technological and financial innovation is required

There is no doubt solar will continue to prosper, after its hiatus, simply because it will form part of an integrated UK power solution to complement growth in offshore wind and nuclear. Solar is extremely flexible, its cost to deploy on a per MW basis continues to tumble, it can be deployed on a localised basis at lower grid levels to support the local area with low carbon power. The use of attractive corporate or utility PPAs, flexible and dynamic revenue streams and time shifting price arbitrage will ensure the technology is here to stay especially given the planning process is condensed compared to nuclear or offshore wind. The challenge for the entire solar value chain will be to rise to the opportunity in hand and aspire to deploy 3GW per annum.

Elgar Middleton’s role in this deployment

Elgar Middleton has extensive debt and equity experience in arranging finance for solar projects in addition to comprehensive knowledge of structuring bankable PPAs and modelling battery solutions for both time shifting and flexible solutions. This experience is ensuring our clients not only design their sites optimally from the outset, but also achieve the lowest cost of capital from the debt markets, thereby maximising their investment returns.