Elgar Middleton continues to support our clients raising debt finance at project and portfolio level within the UK market. This article highlights our current view of the lending market.

Generally, the UK renewables lending market appears to be in good state – all core technologies are being greeted with appropriate funding solutions and lenders’ commitments to the wider sector continues to show growing robustness.

Lender types & domiciles

The UK renewables market continues to not only attract the interest of banks offering project finance debt but also the interest of institutional investors. Elgar Middleton has seen an increase in interest from institutional investors able to offer debt solutions to UK situated projects/ portfolios although it is important to note that institutional investors have not yet proven to be as competitive on pricing when compared to banks.

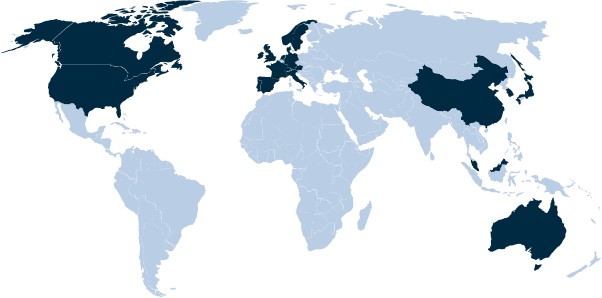

Lenders to the UK renewables market come from all over the world. Elgar Middleton is seeing attractive terms from lenders based in North America, Asia and Australia as well as continued support from familiar lenders in the UK and Europe. This is consistent with the view that the UK remains a leading country with regards to net zero energy production and retains an attractive lending environment.

Elgar Middleton will always look at the lenders’ experience in the UK market during a funding competition as this can offer insights into the long-term relationship between the sponsor and lenders.

Debt products available

Lenders continue to offer a wide array of debt solutions to the UK renewables market with the vast majority able to offer project finance debt accompanied by a VAT facility and derivatives such as interest rate and inflation swaps. Furthermore, most lenders are now comfortable with a debt service reserve facility as opposed to an account.

HoldCo financing options such as acquisition finance and revolving credit facilities are still attractive to some lenders, but they are typically preferred by lenders who are not able to compete in the long term asset level project finance market. Furthermore, it is mostly banks rather than institutional lenders who are capable of offering these facilities.

Preferred ticket size

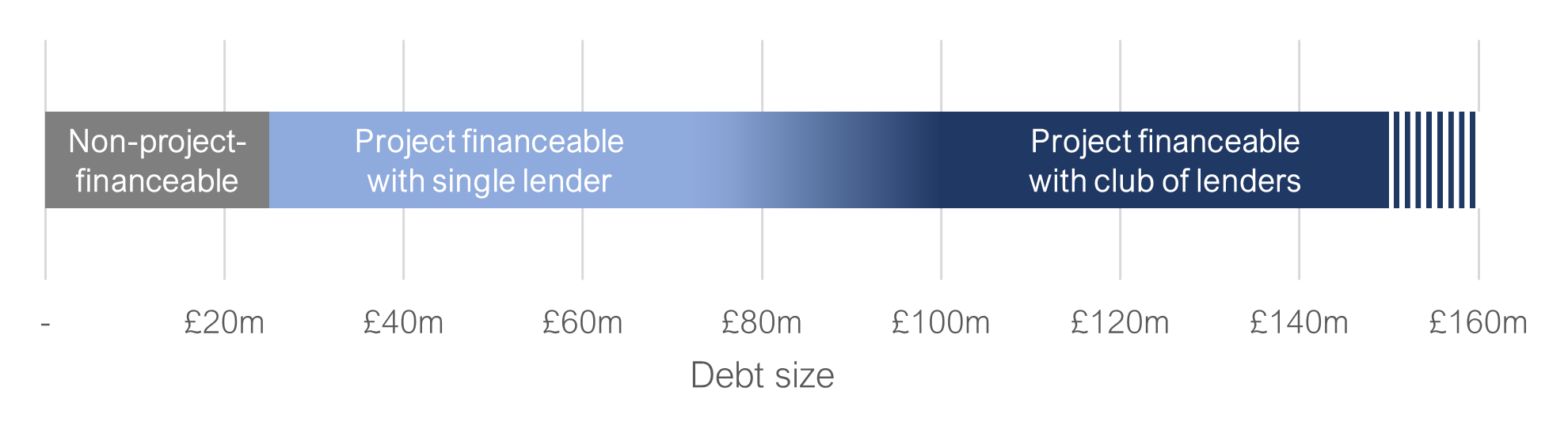

The minimum ticket size for some lenders is now around £25-30m although this can depend on the asset class – the more risky sectors with higher margins can still be profitable with smaller tickets. The sweet spot for many lenders is around £75m on a take and hold basis. Whilst a number of lenders would finance transactions with loans in excess of £100m, they would typically look to sell down some after financial close. This can then lead to discussions around the level of support the sponsors should provide the lenders to help with syndication.

Most financings which require more than £100m of debt will use club deals of at least two lenders. This helps to avoid any discussions, and cost, around underwriting, but it can make it more time consuming to agree terms. This is an area where a well-developed term sheet really helps.

Preferred maturity

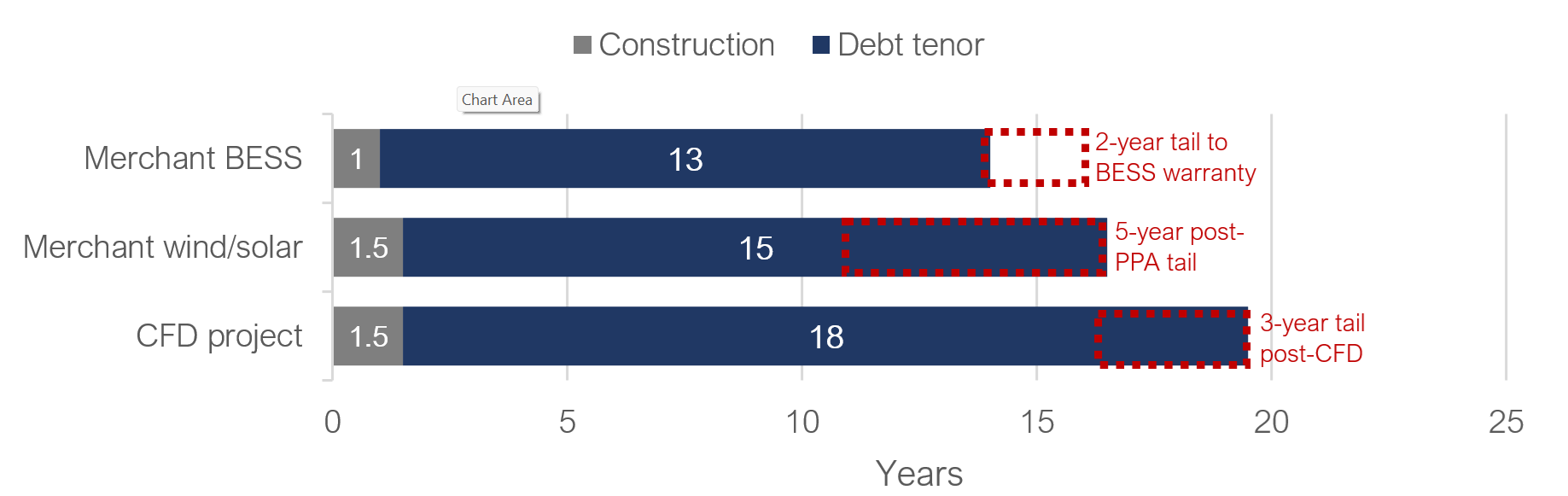

It remains the case that shorter term financing is cheaper and easier for lenders to offer than longer term financing. It therefore has the widest range of interested lenders and is the most competitive option; however, typically when a sponsor factors in the refinancing risk and cost, the long term financing option offers better value for money.

There are now a significant number of lenders who can finance a period of construction plus a 15 year CFD. To be competitive, lenders are required to go beyond the CFD period in the form of a merchant tail. The market has not converged on a standard approach, not helped as always by volatile power curves, but we do think that the market now requires some form of merchant tail, typically at least 3 years. We regularly analyse multiple different permutations available to establish what offers our clients the best option.

Whilst subsidy free wind and solar transactions have declined due to the availability of CFDs, if 10-year bankable corporate PPAs returned to the market, we would expect lenders to finance a merchant tail of at least 5 years. As with the CFD financings, there is not a standard approach and the high breakeven power prices since the energy crisis can be hard for some lenders to accept.

We continue to see enthusiasm for merchant-only battery debt financings. This market is being helped by the competitive nature of the optimiser market where floor prices are offering lenders some fixed revenue protections. We continue to see a requirement for a tail between the debt maturity and the warranty expiry and, as a result, notional loan tenors are now around 10-13 years post COD with a legal tenor of around 5-7 years. In comparison to the wind and solar market, the BESS market continues to evolve at a rapid pace. A key part of what we do at Elgar Middleton is to help with this evolution to ensure the sponsors obtain the very best terms.

Elgar Middleton’s role in debt financing

Elgar Middleton has extensive experience in arranging debt finance for solar, wind and BESS projects having closed 45 debt transactions totalling almost £6bn. In addition to comprehensive knowledge of structuring bankable offtake arrangements and financial modelling to optimise a sponsor’s gearing and equity IRR. This experience assists our clients not only in designing their sites optimally from the outset, but also to achieve the lowest cost of capital from the debt markets, thereby maximising their investment returns.